If a bank said “no” even though you met the minimal requirements, the reason is usually one of the points below. Read your list first. Then use the Fix it tips to improve your chances next time.

Loan rejected in Norway? Check this list first

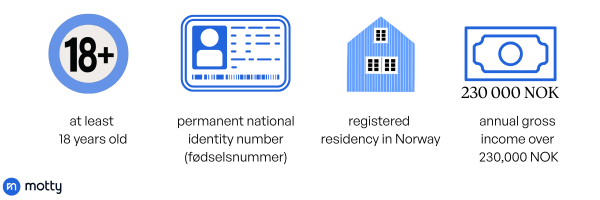

To even start thinking about a loan, you need to meet the conditions:

You met all the requirements and still no offer? Check the list below!

- Too many applications

Everyone tries to find the best offer for every financial part of our life. But in the world of loans, it works the opposite way. If you check offers in many places, all banks can see it. This can cause your personal number to be blocked. Try to apply only once every 30 days, or better, every 60 days.

- High-interest short loans

You have loans with short repayment periods and interest over 25%. These loans are almost impossible to refinance. Just having them lowers your loan ability almost to zero. If you want a better loan from a bank, avoid these loans and pay them off before applying (even using products you already have but do not use, like a credit card).

- Short stay in Norway

Banks check your income by logging into Skatteetaten and looking at the number of your tax reports (skatteoppgjør). It is best to have at least 3 reports. If you have none or only one, the chance to get a loan is very low.

- Debt collection (inkasso)

If you have debt in collection, you cannot get any loan. Pay it off or refinance it in your mortgage (we can help with this).

- Dagpenger or permittering

These two types of income very often cause rejection of applications.

- Too many loans

Some banks allow refinancing only a few loans. If your list of loans is long, even with small amounts, you may be rejected.

- Low income-to-loan ratio

Banks will not let you borrow more than you earn. This is logical.

- High credit limits

You may have a credit line like a credit card or flexible loan with a high limit that you do not use. Banks see this as a normal loan. Reduce your limit to the real amount you need.

Quick Fix tips

| Problem | Fix tip |

|---|---|

| Too many applications | Wait 60 days. Apply once with us. We will check all the offers for you. |

| High-interest short loans | Pay these first. If you use a credit card to do it, lower the card limit right after. Then ask about refinancing. |

| Short stay in Norway | Wait until you have at least one (skatteoppgjør). |

| Inkasso | When it is small – repay it. If it is not possible, ask us about adding it to your mortgage. |

| Dagpenger / permittering | Apply again after you return to regular salary. |

| Too many loans | Ask for refinancing. Add a co-applicant with stable income. |

| Low income-to-loan ratio | Ask for less money or a longer term (lower monthly cost). Add a co-applicant with stable income. |

| High credit limits | Reduce limits to what you really need. Get confirmation from the bank of the new limits before you apply again. |

What to do next (3 easy steps)

- Take a 60-day break and collect documents: ID, work contract, 3–6 payslips, last skatteoppgjør.

- Clean up: pay the expensive small loans, close unused accounts, lower card limits, fix any inkasso.

- Apply once with Motty. We’ll choose the right bank and avoid extra credit checks.

Loan rejected in Norway FAQ (quick answers)

How many applications are “too many”?

More than 2–3 in a month can be a problem. Aim for one every 60 days.

Do credit cards count if I don’t use them?

Yes – limits count. Lower the limit or close the card you don’t need.

Can I get a loan while on dagpenger/permittering?

Usually no. Wait until regular employment and show new payslips.

How long should I live in Norway before applying?

There’s no single rule, but having 3 tax reports is ideal. With fewer, try a smaller amount or wait.

I had inkasso—how long must I wait?

After settlement/closure and registry updates. Keep documents; we’ll guide you on timing.

Can consolidation really help?

Yes – fewer, cheaper loans can improve your monthly budget and your chances.